Thought Leadership

with David Ryan & Grant Rapaport

Over the past few days, a number of people have been asking us for our view, in addition to how we at Rhino Africa are planning to navigate this Covid-19 Crisis. Cognisant of the fact while much has been written about Covid-19, the virus and the economic and human consequences, there has been very little written with specific reference to our Safaris based Tourism Industry. The intention of this collaboration is to articulate the complexity of our Tourism ecosystem, and how that ecosystem will need to work collaboratively as we scenario plan through this uncertainty.

These are indeed unprecedented times, and we are conscious of the fact that we are all doing this for the first time. We are reminded how every business strategy became outdated and irrelevant in just a few weeks, and where we stand today, that “old box” has been well and truly shattered and we can now only think outside of it.

At the heart of this crisis lies uncertainty, and engaging with our mentors, industry peers, partners and associations have all been key to our scenario planning. As we write today, our primary source markets continue to see exponential growth in infections, increasing our belief that a recovery from the effects of Covid-19 will be longer than initially anticipated just a few weeks ago.

In all instances, the recovery of our industry is entirely dependent on the reopening of borders and the resumption of international flights, which will allow for mobility on scale.

Despite what for many may seem like insurmountable challenges related to the impact of Covid-19 on our industry, we need to continue to rise to this generational challenge. We continue to look to tourism as the game-changing force that upliftments communities and protects our wildlife. Tourism enriches so many lives, we need to redouble our efforts and consider every option and plan for all eventualities as we work as an industry to do our part to maintain decades of brand equity and livelihoods built on the foundation of bringing guests to African soil.

In order to ensure economies throughout Sub-Saharan Africa are able to recover in the wake of Covid-19, there is no getting around the fact that tourism must be at the forefront of our recovery, a pillar for economic growth and employment. For that to happen as quickly as possible we need to ensure that the businesses that make up the backbone of our industry, from lead generation to logistics and accommodation are able to survive, in order to meet and entice the return of world demand for African travel.

As a first step to understanding this complex impact this pandemic will have on our interconnected industry we need to identify and understand a number of key factors and beliefs as the basis for our forward planning:

- Treatment and Vaccine horizon

- Ability to Travel from Key Source Markets

- Destination Markets’ Ability to Reopen and Host

- Structural Differences between Flights, Beds and Activities and Tour Operations

- Recovery Tailwinds

Treatment and Vaccine horizon

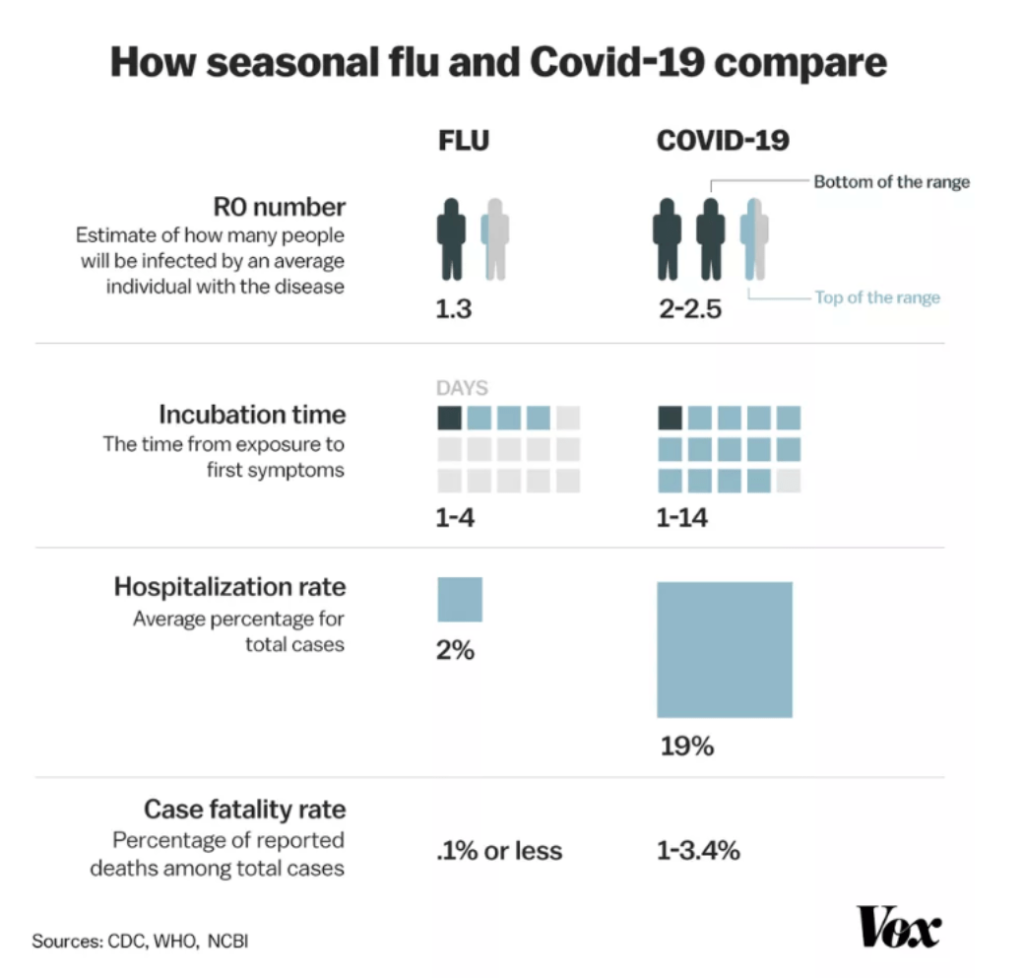

We start with a recognition that there are no existing treatments for Covid-19, despite trials that are underway to test the efficacy of existing drugs, along with the timelines to produce a vaccine. These timelines include the required safety and efficacy through clinical trial results and scaling manufacturing required are estimated to take 12-18 months. As data continues to come in to support high transmission (R0 of 2-2.5) and high hospitalisation (~19%) rates worldwide, the current approach, which focuses on containment is unlikely to be short-lived with extended disruption to international travel.

Ability to Travel from Key Source Markets

Three major factors are required for our key source markets to recover. Simply put there needs to be healthy guests with the disposable income to afford travel and a flight network servicing long-haul destinations in Africa.

Firstly, in general, our primary source markets continue to see exponential growth in infections with slow or late government responses with a few exceptions, like that of Germany’s low mortality rates. Overall experience to date demonstrates a much lower level of containment in both Europe, the UK and the United States than seen in China. Containment in the absence of treatment is a key consideration when considering how countries that are flattening the curve will regulate their borders and restart global mobility. That being said, with the US targeting lower than a 1% infection rate, there will still be a large pool of potential guests given the stabilisation of infection rates and appropriate testing.

Secondly, the money to travel. As we think forward to the restart of local then global economies we need to look beneath the economic turmoil and segment the impact it would have had on different parts of the population in our source markets and their disposable income. Setting aside the travel bans, the economic impact will likely not be born equally across source markets or within them. In rich countries, the burden of this pandemic will sadly fall disproportionately on the working classes. We see a massive shift by knowledge workers to working remotely, shielding their income while physical, generally lower paid labour cannot, and are therefore at higher risk of being laid off. Additionally, we have already seen in the majority of our source markets an unprecedented scale of governments stepping in to fill the gap left by constrained economic activity, further socialising the cost.

This is good news for many private and public companies and their owners and may, therefore, limit the worst impacts of the stock market and private wealth declines. Direct stimulus packages have also been adopted at a time when personal spending is physically constrained and there could well be further pent up demand accumulating, particularly in the luxury and experiential spaces. While this is mixed news, our belief is that our guests’ disposable income may be less impacted than initially thought, driving our recovery in demand for travel post the crisis.

Lastly, flights and the massive infrastructure investment every global city has made to facilitate the movement of people and investment is a fundamental building block of our modern society. Governments have already moved to shore up airlines to ensure they are ready to be part of the global restart in trade and commerce. Like we saw in the aftermath of 9/11, there was a massive and sustained mobilisation of security measures effectively to underwrite the confidence in air travel. That is what we will see repeated as this crisis moves forward. Rapid passenger pre-flight testing will soon become part of the normal airport experience driven by the urgent need to underpin economic recovery with the normalisation of flight service. Asian countries have already employed these techniques to great effect and we can expect rapid iterative improvements as the airports shift their resources to roll out these measures for the dual purpose of containment and the critical return of confidence to the sector.

Destination markets’ ability to reopen and host

While initially concerned that a lack of containment of the virus in the destination (Sub-Saharan Africa) would have a long-term adverse effect on our recovery due to an inability to host, we are encouraged by what we are witnessing locally and regionally, through decisive leadership necessary, given the vulnerability of our populations. These are early days still but cautious optimism is warranted. That said, in a best-case scenario where we are relatively successful in containing the outbreak of Covid-19 in Sub-Saharan Africa, there is still a high probability that our borders may have to remain closed to our primary source markets, not due to an inability to host, but rather the high risk of imported infections.

We take note of the stringent measures China has employed to safeguard its population from an imported resurgence of the virus. These would be harder to deploy in the African context although a combination of far lower inbound volumes and rapidly improving testing capacity as well as investments made at departure points may prove sufficient. We also note that countries like South Africa have deep infectious diseases knowhow which would support these efforts.

Current key source and Destination Full and Partial Lockdown status:

Structural Differences Between Flights, Tour Operations and Beds and Activities

In order to understand how this crisis plays out in the local tourism market, we have broken the industry into three major components to understand the vastly different recovery scenario impacts. Flights, our industries’ logistical backbone, Bed Operations and Tour Operators. Overall based on our assessment we note that current widespread travel bans have dried up revenue generation throughout the sector. For each major area, the operational requirements triggered by this disruption are first acutely felt by Tour Operators needing to shift significant resources into moving bookings while Flights and Beds are mothballed in the short term. Flights and new bookings for Tour Operations are then the next to see recovery followed last by Beds and Activities.

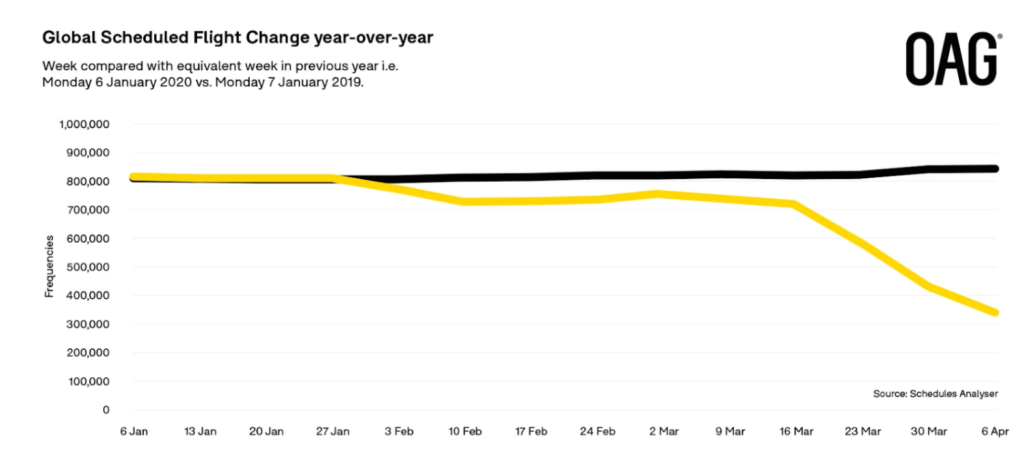

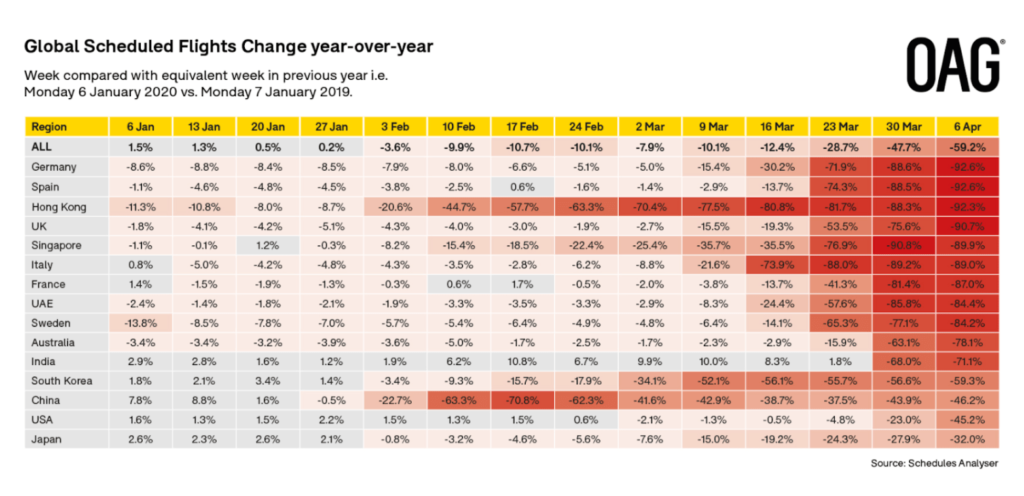

- Flights

As we have seen, the extent of travel bans has arguably had the most direct and immediate impact on airlines with an unprecedented number of long haul flights no longer operating, and limited domestic and regional flights feeder connections continuing in all source markets. One benefit in this space is flight bookings are highly automated and includes real-time visibility which allows airlines to have the most scalable and agile responses to market changes in booking demand as it returns and plenty of capacity to be returned to service.

That being said, actual flight operations are far more complex and require a coordinated response with each airport, government and regulator to operate especially as one could expect necessary controls on movement in this phase of the containment of the virus. Routes are likely to come back in a piecemeal fashion based on regional and international routings that show credible and sustained control over the virus as commerce returns. In Sub-Saharan Africa, this is too early to tell, but flights and in particular SA Airlink’s domestic and regional network will be a critical backbone service for the return of any form of scaled, safari focused tourism. We expect this to start with limited service in conjunction with robust rapid Covid-19 testing facilities at and around airports given the risks associated with travel and reigniting localised epidemics once we see containment measures lifted.

- Tour Operations

Existing bookings – unlike airlines with loaded, scheduled products in a largely homogeneous marketplace, Tour Operations involve the connection of guests, logistics, activities and accommodation in the curation of tailor-made holidays. Hence in the first phase of this crisis, we have dealt with record volumes of guests scheduled to travel in March and into Q2 that had to either be postponed or in some cases cancelled, requiring our entire capacity to be directed at these tasks, all without any additional revenue to contribute these incremental costs. In ordinary times the full-service B2C model does necessitate multiple touchpoints that increase the workload but this is worth the investment in the long term as we see repeat and referral guests drive our growth. In times of crisis, this also allows us the clear benefit of having a primary voice in ensuring our guests can be presented and consider all options available to avoid cancellations. Through this relationship-centric approach we have seen positive results in maintaining a large proportion of the forward book which will aid the recovery of both flights and beds with a base load of guest arrivals in the future.

New bookings – we have seen a dramatic drop off in online search interest in the last 45 days as the world is preoccupied with the immediate impact of Covid-19. This will change over time as we see search interest and enquiries slowly return as potential guests see more certainty in the future which currently looks too cloudy to facilitate commitment to future travel. As this interest returns, we expect to see average lead times (booking to travel) for high-end guests which are normally six months to potentially be even longer as we saw post other health scares like Ebola. The search interest return and the lead time we will see will be extended if governments and airlines don’t set clear expectations regarding schedules and border control regulations which have the ability to reassure guests if done well. What we do not need is stories of flight cancellations or self-inflicted wounds through policies like we saw in the unabridged birth certificate saga.

Regardless of the facts on the ground Tour Operations will be at the forefront of disseminating accurate reliable real-time information related to the inevitable patchwork of additional travel restrictions, in addition to the ongoing need for guiding clients back to Africa in order to facilitate guest conversion. Industry associations like SATSA, TBCSA, ATTA and TSA will need to coordinate closely with regional and international governments to ensure certainty and clarity is the goal of all messaging.

- Beds and Activities

Accommodation and related activities are fundamentally driven by heads in beds. Therefore, the timing delay until we see guests arriving back into Sub-Saharan Africa at scale is the critical driver to bed operations recovery. As a long haul international destination, this will be significantly impacted by the success of all the factors we have identified. While international markets remain closed, we can expect some short- to medium-term demand from our domestic and regional markets. These will require adjustments to operations and pricing in many cases. Given the small size of the local luxury market, this will be limited in volume and drive significant price flexibility and SADC rates.

For bed owners, one will need to weigh the financial and human costs of mothballing operations versus those related to adapting operations for local demand and the ability to generate domestic or regional demand in the short term. Added to these risks, if history from the 2010 Fifa World Cup reminds us of anything, it’s during times of low occupancy, as experienced post the 2008/9 Financial crisis, a gluttony of highly discounted 5 and 6-star beds is hugely detrimental to bed suppliers that are geared to servicing the 3 and 4-star markets.

As international arrivals start to scale these arrivals will displace local demand. The sheer complexity of the international travel ecosystem, that we have taken for granted over the last 20 years, presents timing risks to be managed and monitored in order to transition pricing strategy while managing occupancies.

The lead times highlighted in the Tour Operator section then need to be considered in the recovery which adds additional time to the road to bed occupancy recovery. That is also why deferral, rather than cancellation of current future travel pipelines is so critical as these international arrivals will provide support for bed owners as the buildup of new bookings ramps up in the 6 to 12-month timeframe. The recognition of these structural constraints is critical for bed operators to plan for ensuring sustainable operating cost levels are achieved rapidly post local lockdown periods or alternatively access to bridge funding is secured to ride out this layered demand recovery.

We are conscious that as the travel bans persist, there is a large amount of international travel still booked for travel through the next 6 months that may require postponement creating great adversity and complexity to bed, flight and logistical services.

Recovery Tailwinds

- Emerging Market Currency Weakness

We have seen a perfect storm of credit downgrades in South Africa, flight to quality and upcoming necessary government fiscal and monetary policy interventions that have already significantly changed country and regional financial risk profiles of the developing world. We have seen this in 15-25% currency weakening in South Africa and its direct neighbors and closer to 40% in the Zambian Kwacha while East African destinations have been spared with 10-15% declines this year. This bodes well for destination competitiveness for an industry that still hasn’t largely moved to dynamic pricing.

- Availability and Lowered Operating Costs

As we have seen significant demand side shocks we have seen and expect further price reductions from suppliers especially in the short-term and holding or reductions in 2020 rates. Weaker regional currencies, mean African beds, will be trading at 2014 / 2015 US dollar pricing levels, with little appetite from bed suppliers to increase rates due to lack of occupancy through the better part of 2020. With labor market disruptions and lower oil prices, for the first time, a depreciation in regional currencies will not mean a direct increase in inflation, further dampening the requirement for price increases. On the contrary, we predict that US $ priced bed rates will need to decline into 2021 if they want to compete with their Rand-based counterparts, as they brace for a recovery in occupancies. This bodes well for destinations like South Africa and Namibia but will require a competitiveness review for destinations like Botswana, Zambia, Zimbabwe and East Africa that largely follow US $ based pricing. Thus if bed operators were to work with a common purpose, our road to recovery could be further aided by ensuring highly competitive destination pricing. This extends to lower long-haul airfares which are also likely in the medium term as loads build and are aided by oil prices that look set to remain low.

- Psychology

While Covid-19 is deeply impacting all of us, we know that this moment will pass and travel will be back, because the desire to connect is in all of us. We are seeing people throughout the world find innovative ways to feed that need during this time of isolation and we expect the need to connect and embrace life and experiences will be stronger than ever once the forced isolation eases. Our belief is, therefore, that the psychology of mortality enhances a desire for connectedness that will drive an increased demand for experience. And with a developing consciousness, Africa has both experiences and connectedness in abundance. As we all know, there are few places in the world that families and loved ones can come to reconnect for long hours everyday, away from the distractions of endless Zoom meetings and chat apps, like that of the back of a Land Rover.

- Giving Back

In addition to the incredible experiences Africa has to offer, the shared humanity of this crisis which is truly Global has already seen millions of people and businesses stepping up to support those in need. The established indirect and direct connection between tourism and poverty alleviation, education and wildlife preservation should all be strong drivers of both our industry leaders in this time of crisis, as well as additional motivators for our guests to come back to Africa in support of these amazing causes. The reality is as destinations and source markets reopen, guests will have a plethora of options available for travel and few destinations have the impact story so closely linked to why travel to Africa should be at the top of the list of those guests with that consciousness to give back.

Pulling All This Together – What Is In Store?

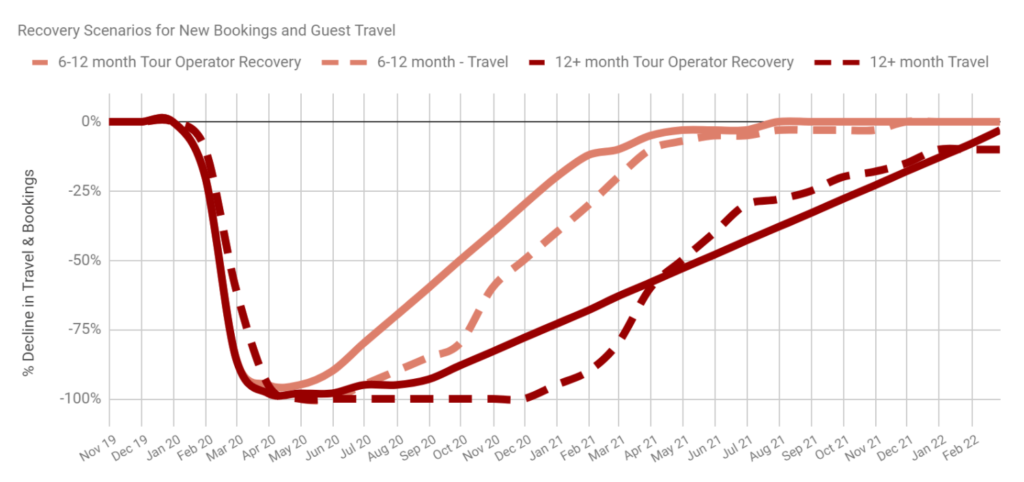

Having identified the major trends and structural elements we are tracking, we have entered our scenario assessment as we plot the way forward for our business. With a strong conviction that this moment will pass and travel will be back, our immediate attention is focused on how we endure and see this Covid-19 crisis playing out. Here we have chosen to focus on two primary scenarios. The first being a 6-12 month time frame to rein in the pandemic and restart travel and the second looking at 12+ months as the pandemic continues.

As we examine the current situation we have already discounted a third scenario, that Covid-19 would last between 3 and 6 months. A best-case scenario where we are relatively successful in containing the outbreak of Covid-19 in Sub-Saharan Africa, given the developments in our source markets, there is a high probability that our borders may not be able to be opened to these high-risk countries for some time, leading to the discounting of the optimistic scenario.

Both our scenario plans for recovery, starts with the premise that capacity will be required as we anticipate all travel booked and scheduled to end July 2020 will need to be postponed to future dates and August to October travel should be considered at risk based on the structural factors identified.

Scenario 1: A 6 to 12-Month Disruption Due to the Pandemic

Our base-case scenario for planning a recovery strategy for Rhino is based on the premise of virus containment within a 6 to 12 month period. What does this look like? In this scenario, the curve has largely been flattened globally (most critically in our key source and destination markets), which means the healthcare infrastructure is coping, and people and businesses are returning to their normal economic activities. Airlines have resumed consistent service between major airports though likely at a reduced frequency to start. Airports and governments have worked to implement procedures to ensure the safety of passengers and destination populations most likely utilising rapid testing capacity at airports pre-boarding meaning that all passengers are COVID-19 negative and facilitating the responsible relaxation of border controls.

Once the logistics are in place, confidence will be the most critical factor that will dictate the speed of recovery for travel at scale. In this scenario, governments in source and destination countries work closely to establish and roll out testing guidelines like those currently commonplace in the airport security sector. This will give guests the confidence to travel and not be denied entry on arrival, or on their return. The memories of forced quarantine post-arrival will be fresh in everyone’s minds and this will need to be counterbalanced by clear, consistent guidelines. The more globally accepted, the better.

All governments will now be on high alert having paid a huge economic price for the required containment steps and the cost of moving too quickly will be well known. These containment efforts in Southern and Sub-Saharan Africa have been predominantly successful through a combination of aggressive lockdowns, testing improvements, and learning from the experience of the northern hemisphere countries. This will allow the easing of domestic and regional mobility by mid-year and as measures taken to prevent the spread of Covid-19 in this process show results this will give governments the confidence to fully re-open borders to key long haul destinations. Inevitable health issues will come up but rapid response teams will efficiently deal with these in a private-public partnership to widespread praise proving greater tangible confidence that tourism is back fueling the recovery and bookings as a result.

During the initial phase, we expect to see some opportunistic local demand for high-end, experience-based leisure travel at lower yields and business travel as executives reconnect and realign their businesses post isolation. Specials targeted at local markets would support this first phase recovery and could be necessary to build confidence in the staying power of the destination’s sustained containment efforts. This would send a strong signal internally and externally that “We are open for business” aiding our medium-term recovery and getting operations back on track.

International arrivals will take some time to ramp up as distressed airlines that would initially focus on short, profitable routes and avoid higher risk, load-dependent long haul routes. This wait and see approach from both governments and airlines are likely to limit volumes throughout July to September and as demand picks up we expect to see long haul flight schedules start to return to regular schedules in Q4 2020. Coinciding with these confidence-building measures some of the existing forward book of guests will be able to travel in Q3 and will work through the system over the next 6 quarters through Q4 2021.

Lead generation will start to pick up as the acute shock of Covid-19 wanes but we expect these early signs of life in search interest and repeat guests to require significantly longer to convert to bookings as all guests will be waiting to see consistent signs of recovery. The return of travel insurers to the market and/or upfront flexibility from bed, flight and logistic providers on more flexible terms. As confidence returns, search interest will increase as well as improved conversion ratios to booking and shorter conversion and lead times. Destination longer-term macro trends will again start to emerge unless regional branding is improved to change this picture. In the two years pre Covid-19, destinations like South Africa were already witnessing annual declines in arrival numbers from our traditional markets, placing added pressure on many long-haul carriers’ viability into Southern Africa. This was not the case in East Africa which had been witnessing year on year growth.

If in line with our scenario analysis, if we witness a containment of Covid-19 within a 6 to 12 month period and the associated certainties around international mobility, we would expect to see a recovery in Tour Operator bookings commencing in late Q2, steadily improving into early 2021. Travel dates would lag this with currently scheduled guests and some new bookings expected to start travelling in larger numbers from late Q3 2020 and into the middle of 2021.

One remains cognisant of the fact that, due to the postponement of current forward books into late 2020, 2021, new bookings potentially face availability challenges and hence the latter half of 2021 could be a bumper year for tourism as we see overflow into shoulder seasons as the postponements of Mar to Sep 2020 travel take up peak availability in late 2020 and 2021.

Scenario 2: A 12+ Months as the Pandemic Continues

Our second scenario in planning a recovery strategy for Rhino is based on the premise that virus containment efforts are less successful in one or both of our key source and destination markets. The premise of this scenario includes several rolling waves of travel bans and lockdowns, that are necessary as stretched healthcare systems are unable to cope as Covid-19 persists through the northern summer and even possible resurgence in Northern Hemisphere’s Autumn/Fall 2020.

That being said, as the initial shock turns to more coordinated action, increased surge hospital capacity, the advent of treatments, and newly galvanised world populations educated in the importance of basic precautions, a reduction in the R0 and mortality is possible moving Covid closer to a serious, but manageable enemy as we forge an uneasy peace with the virus waiting for widespread vaccine availabilities and increased recovered populations into 2021. These conditions, though not ideal, will mean increased economic hardship and longer travel restrictions. These elements will reduce the buying power of even high-end guests significantly and mean that the crucial element of confidence in travel will simply take longer to establish.

This delayed slower recovery means international tourism volumes would be expected to remain very low for the remainder of 2020, only increasing in 2021 and into 2022. Booking lead times will mean that we will see an extended period of low search interest and enquiries, with limited recovery starting in Q4 2020 for Tour Operators. This may well cause availability issues in 2021 as 2 years of adjusted demand is working to travel in the same shortened period. The impact of this supply constraint will need to be assessed as we see more data into Q3 2020.

The below graph depicts these two recovery scenarios from the baseline of 0% representing volumes prior to Covid-19. As you can see Bed/Flights delivery (dotted line) lags Tour Operator demand (solid line) in both cases. Our experience was a sharp drop off in demand starting in the second half of February 2020 and rapidly accelerating into March culminating with the lockdown of Southern Africa in late March. The bookings moved from existing 2020 travel dates can be seen to aid travel volumes recovery in the months following the restart of travel and will be highly sensitive to confidence levels discussed previously.

However fleeting or long-lived, no business will emerge from this crisis without significant change, and hence our attention is now focused on how best to adjust our operations and structures to ensure we can continue to serve our guests and suppliers in either of these scenarios. Whether your belief is that this crisis will be short or long-lived, the road to recovery, to returning to pre Covid-19 booking numbers and sales will require different areas of focus, expertise and capacity.

In the absence of substantive Government intervention or rescue funding, now is the time that many of our partners and peers will need to focus on using this crisis to recalibrate our businesses. In the case of Rhino, that is to ensure that when we emerge, we are able to increase our market share and productivity as we play our role in the recovery of this industry we all love so much.

As our friend and mentor Colin Bell so aptly put it: “There is no question that when tourism does come back, Africa will be in a much better position than it was before Covid-19. Under tourism destinations will be in more demand than before the crisis.”

Consequences of Covid-19 in Shaping our Industry

Somewhat controversial and arguably self-serving, perhaps the most significant shift we will see as a result of this Covid-19 pandemic, is the accelerated channel distribution in favour of the B2C channel, as the value of direct client relationships and data required to understand and serve them comes to the fore in the management of clients through a crisis. Bed operators will note a stark difference between both the rate of cancellations and the standard terms and conditions being applied by the various channels, which are directly related to the ability to manage clients through a relationship of trust and on the ground expertise.

B2C Tour Operators share a unique connectedness with their clients through months of intimately planning and suggesting routes, logistics, activities and accommodations as we curate tailor-made experiences. That connectedness, while increasing workload, has the significant benefit in times of crisis of allowing us to continue that experience of weighing options and scenarios with our guests ensuring we consider the best course of action. This requires consideration for and translating of the significant complexity in play behind the scenes to ensure all options available and thereby maintaining a large proportion of the forward book for when travel returns. In addition, as conditions improve history will show that B2C’s led our recovery through proactively mobilising new, repeat and referral clients to connect with suppliers that have gaps in occupancy and specials as we do our part to rebuild occupancies faster than any other available channel. More than ever, on the ground knowledge and experience will be invaluable as clients shaken by the disruptions caused in all areas of life by Covid-19 will need information and reassurance that we have their backs as they cautiously return to rediscover Africa.

Final Thoughts

As such, we are reminded that now is not the time to fear, falter or hide, for in this moment, however fleeting or long-lived, is our chance as a generation and industry to leave our mark. With that in mind, we recognise the need to redefine and restructure our business, even more than ever before; not only to create better value for our guests, our people and our partners, but to ensure we are able to survive this crisis.

We recognise that it is in times of uncertainty that people remember those who were there and chose to make a difference. On that note, we would like to thank every one of our Rhinos, mentors, partners, peers and industry associations that have come together to work with a common purpose as we navigate this challenge together.

As this progresses, we all have the opportunity to spread hope, knowledge and humanity with one another, as everyone continues to seek ways to fill their time with purpose and a sense of connectedness. While no business will emerge from this crisis without significant change, we thank you for being part of the Rhino story. We’re making history, and we’re going to be okay as an industry – together.

David and Grant

Source: Rhino Africa