The news of the Brexit vote took the UK, Europe and the world by surprise, bringing instability and high uncertainty to the airline industry, reminiscent of the financial crisis of 2008. The airline sector is not unfamiliar to disruption but the repercussions following Brexit are expected to cause huge tremors, not only in the UK but also Europe.

The UK, as a traditionally strong outbound market, is expected to be hurt as travellers monitor their budgets closely, with disposable income squeezed by devaluation of sterling and unfavourable exchange rates. This is likely to be reflected in slowing airline passenger flows and poorer corporate revenues. Add to this the uncertain status of the Open Skies Agreement, which the UK is currently a member of as part of the EU, the crippling Aviation Passenger Duty, and one can see that the future of the airline sector in the UK is paved with thorns. The fear factor has already spread its wings among major carriers such as Ryanair and easyJet, with the latter contemplating leaving the UK to establish its headquarters elsewhere in Europe while the Irish airline decided to quickly cut airline capacity in the UK, shifting to European markets such as Spain, Italy and Germany. The financial markets have not been forgiving either, with shares tumbling sharply for carriers such as IAG, Lufthansa and easyJet.

Outbound departures key for the airline sector

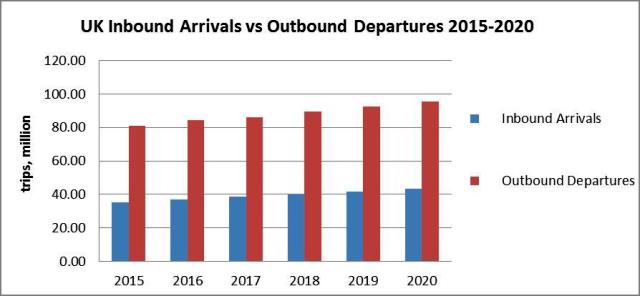

The UK is a strong outbound market, with British holidaymakers traditionally opting to travel to Europe, with Spain being the number one destination. Outbound trips from the UK grew 7% in 2015, totalling 81 million trips, while international arrivals reached 35 million trips in the same year.

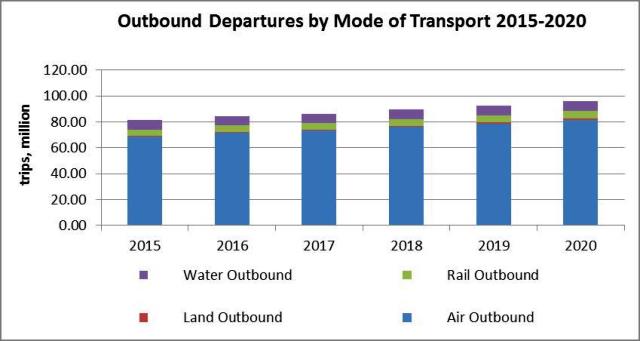

The airline sector is the primary beneficiary of such a high level of outbound departures, as the preferred mode of transport for UK travellers. The shockwaves of Brexit, however, are expected to lead to slowing demand and deteriorating leisure and business spend on the back of weaker local currency, which will make the travel proposition all together more expensive.

The repercussions of these developments will become a taxing factor for the revenue books of airline players. Many carriers will be forced to cut capacity on short-haul destinations which will slow down aggressive expansion (eg Wizzair’s growth in UK) and aircraft orders, especially for those airlines which are primarily active in Europe. Despite the fact that most airlines have hedging programmes in place, future fluctuations of fuel prices could still drive costs up for many operators. Less supply on the market will then drive higher ticket prices, which will ultimately hurt the end consumer.

Open Skies Agreement is the hot potato

But the biggest problem for the aviation industry in the UK could come from any regulatory changes introduced following Brexit, which will involve review of the membership of the country in the European Common Aviation Area (ECAA). Currently the UK is reaping the benefits of the liberalised single market, which served as a helping hand for the flourishing of the low cost business model in the region and the success Ryanair, Wizzair and easyJet, among others.

The Open Skies Agreement in Europe not only boosted traffic and economic movement between EU member states and made air travel affordable to the wider customer base but also allowed European airlines to operate commercial services as well as domestic flights in non-domicile markets (eg Ryanair operating domestic flights in Italy) without any pricing, frequency or capacity limitations. This is a key advantage, as seen in the case of the Gulf players which have been struggling to expand in Europe due to stringent EU protectionist policies.

If the UK is no longer a member of ECAA, upon exit terms, bilateral agreements between the country and each of the EU member states must be signed. This will not be straightforward and potentially could be rather messy and a lengthy process to resolve. Brexit will also impact the benefits of the EU-US Air Transport Agreement, which will have to be replaced by a new agreement.

Provided the UK leaves the single EU aviation market, a snowball effect could trigger airlines to explore opportunities for establishing bases outside of the UK such as easyJet or bmi regional, in a bid to insulate themselves from the uncertainty surrounding EU withdrawal. The country could therefore lose its status of key transportation hub, not least due to the existing restraints of the Aviation Passenger Duty and potential delay of airport expansion in London.

Clouds in the sky – airlines taking the hit already

Airlines in the UK such as easyJet, IAG and Ryanair were the first to feel the impact of the Brexit referendum, with their shares tumbling, by over 25% in some cases, after the result was announced. The dire situation in which these airlines operate has been further aggravated by the recent terrorist attacks in Europe, industrial action in countries such as France and other political instability in the region (ie the recent failed military coup in Turkey). The shares drop in turn has pushed airlines to lower profit targets across the board.

However, the travel industry has proven its resilience in the past, and airlines are introducing proactive actions. Players such as easyJet and Wizzair are applying for an air operator’s certificate (AOC) that can allow them to fly between the UK and Europe no matter what the UK-EU negotiations result in. That said, difficulties will continue to plague the sector, especially if sterling continues to weaken. Although the devaluation of the currency will boost the attractiveness of the UK as a destination thus increasing international holidaymakers in the country, this will not be sufficient to offset the drop in the dominant outbound departures segment.

Euromonitor International partnering for the 11th consecutive year with World Travel Market is pleased to reveal the emerging global travel trends identified by the WTM Global Trends Report on Tuesday 8th of November at London’s ExCel Centre.

To receive a free copy of last year’s WTM Global Trends Report 2015, please click HERE.