The mantra ‘travel is back’ is no longer resonating with consumers, who are demanding personalised experiences that suit their values and lifestyles. To connect authentically with these travellers, travel players must look beyond advertising to marketing, positioning and loyalty.

Euromonitor International has developed eight traveller segments to capture evolving motivations using new data from Euromonitor’s Voice of the Consumer: Travel Survey. Each segment has a unique view on travel, and a singular messaging strategy is not enough to drive business from all segments. Travel businesses that wish to target these segments should consider carefully how to tailor their messaging to individual segments’ expectations and needs.

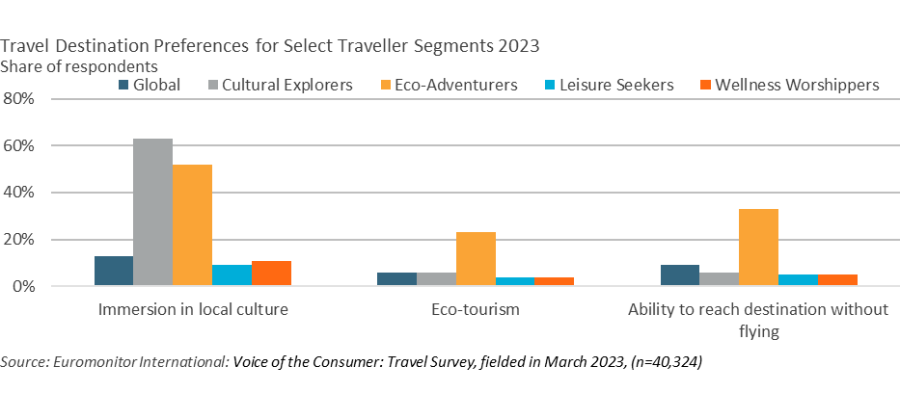

Eco-Adventurers and Cultural Explorers take a holistic approach to sustainability

Sustainability emerges as a theme across multiple traveller segments. Some segments, such as Eco-Adventurers, focus on sustainability itself. Others, such as Cultural Explorers, may be more attracted to the value of the experience. The key to unlocking interest in sustainable travel across the board is how companies frame their sustainability initiatives.

Eco-Adventurers show a much higher affinity for environmentally sustainable initiatives than other traveller segments such as choosing eco-tourism (23% of respondents) and alternative transport options to flying (33%). When asked about immersion in local culture, a byword for socially sustainable travel, Cultural Explorers are nearly five times more interested than the global average at 63% of respondents.

As climate change continues to threaten the very destinations and communities that tourism depends on, sustainability will only become ever more important. To drive more interest in sustainable travel options, travel players need to balance promoting experiential value and the sustainable benefits. According to Euromonitor’s Voice of the Consumer: Travel Survey, 79% of both Eco-Adventurers and Cultural Explorers are willing to pay up to 10% more for sustainable travel features.

To convince travellers to spend on sustainable options, destinations must show how they benefit travellers’ experience. If destinations promote the quality of shopping at local merchants while also emphasising the direct benefit that brings to the local community in terms of job creation and opportunities, this will attract more interest and engagement.

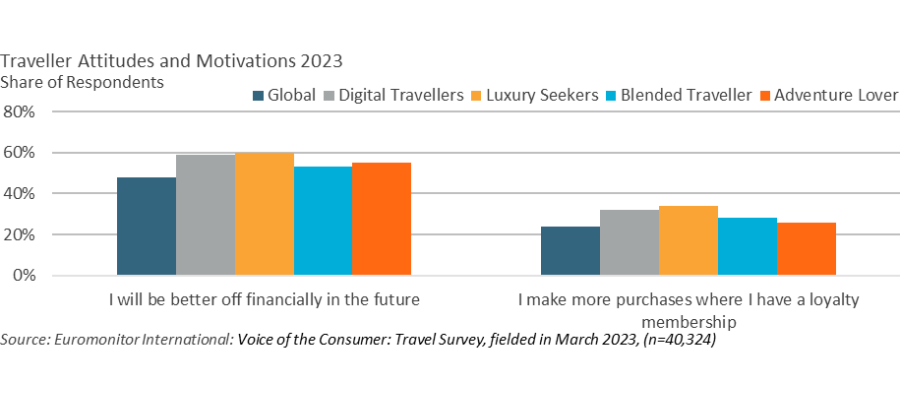

Luxury Seekers and Digital Travellers seek high-end experiences with perks

Luxury Seekers and Digital Travellers are the segments most focused on high-end travel. These travellers have become especially important post-pandemic, as travel companies look to high-spending leisure travellers to make up for lost business travel revenues. 60% of Luxury Seekers and 59% of Digital Travellers believe their finances will improve in the future, more than 10 percentage points above the global average.

These segments’ interest in luxury travel also makes them ideal candidates for one of the travel industry’s biggest focus areas: loyalty. Companies including Expedia, Delta, and Accor have all launched major loyalty initiatives this year. Loyalty’s importance has risen as it is a profit driver for the industry, thanks to co-branded credit cards. 34% of Luxury Seekers and 32% of Digital Travellers prefer to shop from merchants that offer a loyalty programme, making these segments especially profitable for travel companies.

Even with both segments interested in loyalty, they may prefer different benefits of loyalty. Luxury Seekers are experience-driven and want access to exclusive, upscale experiences in return for their loyalty. Digital Travellers, meanwhile, look for seamless digital experiences and personalised offers. Tailored messaging is always key when considering different traveller segments.

Focusing on luxury will be important for travel companies over the coming years. Euromonitor projects that luxury hotels will post a 7.1% CAGR over 2023-2028. Luxury hotels will also be the first segment of the hotel market to fully recover, along with upscale hotels. With high-income consumers more resilient and less susceptible to the cost-of-living crisis, their spending will have a significant impact on which companies gain or lose market share.

Cost-of-living crisis weighs heavily on travellers’ decisions

As travel bookings recover from the pandemic, travellers are feeling the burden of the cost-of-living crisis. Euromonitor projects that the global average spend per international trip will increase more than 8% in 2023 to USD1,360 due to rising costs and inflation. Rising costs are having the greatest impact on the Leisure Seeker segment that looks for budget-friendly travel options. Leisure Seekers have a greater representation in lower to middle-income levels compared to other traveller segments.

While 23% of global respondents fit into the Leisure Seeker segment, 32% of respondents in Latin America belong to this. The over-representation of Latin America reflects the region’s challenges with inflation and the need for some Latin Americans to seek out budget-friendly travel options.

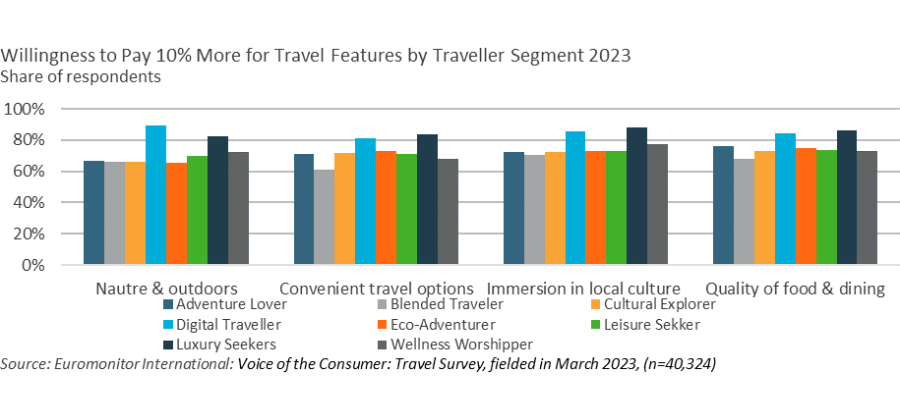

The cost-of-living crisis does not mean that travellers will not splurge on their trips. Rather, they will be more discerning with their spending decisions. Blended Travellers, for example, may swap international travel for domestic trips. While many may imagine this segment working abroad, only 10% of the segment reported a desire to do so in Euromonitor’s Voice of the Consumer: Travel Survey.

Across the board, Euromonitor’s traveller segments show a willingness to pay extra for desirable travel features such as convenience and sustainability. Immersion in local culture and quality of food and dining resonate with Digital Travellers and Luxury Seekers. Promoting the unique value of these experiences will help convince travellers to spend more on quality, even as the global economy continues to face challenges.

Navigating the uncertain year ahead

As international travel nears full recovery post-pandemic, travel providers must shift their focus to fostering sustainable growth. This growth will not come easy. The sector is facing a challenging macroeconomic environment and forecast data for 2023 already shows slowing growth for travel demand to 40% for international tourism spending.

To navigate this uncertain environment, travel companies should re-focus on tailoring discrete messaging to individual traveller segments. Those that understand how traveller segments are evolving will be better positioned to connect with their customers and earn a competitive edge in the challenging year ahead.

Learn more about Euromonitor’s new traveller segments at our WTM London session, Identifying the Traveller of the Future.

Join us at World Travel Market London

The market leading travel and tourism event brings the whole world together in London.

Join us from 6–8 November 2023 at ExCeL London.