In a time of peak-employment, with fewer people out of work and the best talent in high demand, you’d think companies would be doing everything possible to build relationships and foster goodwill with employees. Apparently not, as new research by market leading foreign exchange and international payments company Caxton, reveals that when it comes to corporate spending, 35%* of businesses expect their employees to cough up for business expenses themselves.

Whether at home in the UK or overseas, 1 in 5 (19%) employees have to use their own cash, and a further 1 in 6 (16%) rack up the spend on a personal credit or debit card. Employees working for an SME (an organisation with less than £10m in annual revenue) fare much worse with 48% expected to pay for their own travel expenses, and 46% having to use their personal credit or debit card to fill up at the pump. It’s no wonder 1 in 3 employees have experienced cash-flow issues as a result**.

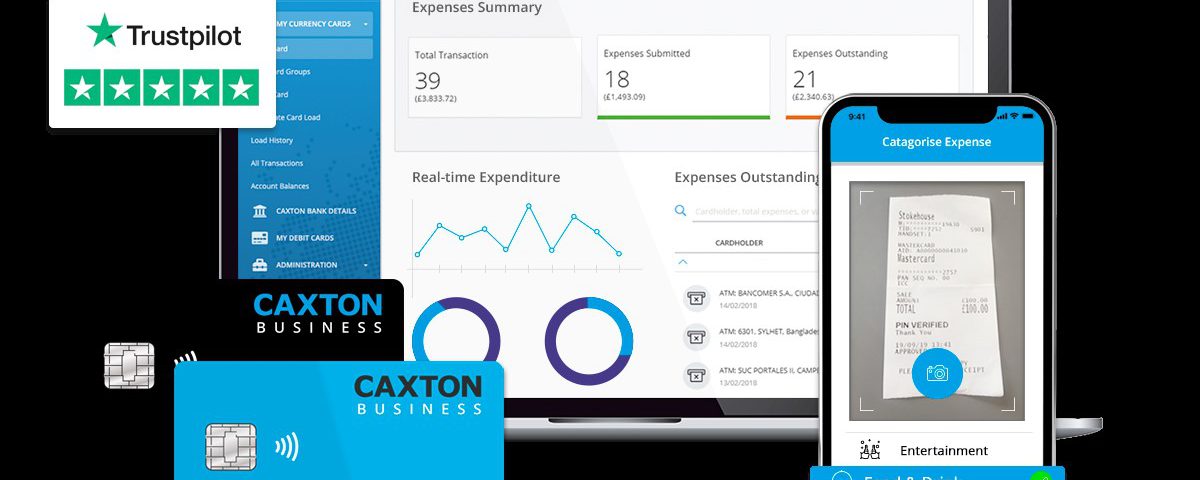

These findings coincide with the launch of Caxton’s new Business management platform that provides a fully automated expense solution, including a choice of two different corporate cards – removing the unnecessary burden placed on employees to use their own money. A supporting mobile app makes it easier for employees to quickly capture, upload and categorise their receipts, while a back-end functionality enables accounts teams to efficiently track and manage expenses in real time for greater visibility, peace of mind, and more control of business spending.

State of business expenses across the UK

The research questioned 150 financial controllers, managers and directors responsible for corporate expenses and FX payments in companies with 50 plus employees, and also paints an interesting picture of the state of business expenses nationwide. Given that there are 43,000 businesses, each employing more than 50 people and accounting for over 50% of employment in the UK, employee “lending” per business equates to £81k according to Caxton’s findings. Across the UK, this amounts to a staggering £3.5bn***!

Commenting on the research, Jane-Emma Peerless, Chief Commercial Officer at Caxton said: “Whether companies are intentionally using employees’ bank balances as an unauthorised line of credit or not, they need to understand the real impact of their expense policy on staffs’ personal finances – especially for people on lower salaries and those incurring regular expenses on business trips both here in the UK and overseas.

“Our study shows that not only are 35% paying for work items with their own money, they are having to wait, on average, 18 days to be repaid. It takes almost three days longer to reimburse employees when a company uses manual reconciliation. However, thanks to technology, this is all changing, and fast. Caxton’s new business expense platform focuses on reducing paperwork while addressing misuse and fraud, and helps companies take control of their business expenses so employees are not waiting to be reimbursed.”

Stand: TT530

PR Contact: Sonia Rehill

Email: sonia.rehill@caxtonfx.com

Tel: +44 (0) 20 7042 7648

Mob: +44 (0) 7968 747331

* Based on research conducted by Censuswide on behalf of Caxton between 23.07.2019 – 01.08.2019 Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principle.

150 respondents are financial controllers, managers and directors responsible for expenses and FX payments in companies with 50+ employees and which spend £500k+ on foreign currency transactions per year.

** Page 22 of the UK SME Banking & Payments Council H1 2018 by RFI Research. Cash flow issues stat cited from Global Banking & Finance Review – 16/08/2018

*** Calculations are based on survey responses to the following questions:

Annual budget for employees’ expenses = £229,450

How do employees usually pay for business expenses = 35.3% (Personal/Own Cash)

£229,450 x 35.3% = £80,995.85 – rounded off to £81k per business in release

Number of Employees regularly submitting expense claims within the business = 63.6 *81k/63.6 = £1274 for individual lending to employer.

Number of businesses in the UK with more than 50+ employees = 43,000 taken from House of Commons Briefing Paper – Number 06152 – 12 December 2018 (Medium businesses = 35,000 plus 8,000 Large)

£80,9995.85 x 43,000 = 3,482,821,550 rounded off to £3.5bn for UK wide figure