Cyprus-born platform shows how travel brands can lift approvals, cut costs, and launch local payments faster without replatforming.

BridgerPay, the Cyprus-based payments orchestration platform, will exhibit at WTM London 2025 (4-6 November, Stand S3-100). BridgerPay helps travel brands turn payments into a growth lever, raising approval rates, reducing friction and operations workload, and simplifying reporting across providers, via a single API and dashboard.

“Payments should convert, not complicate,” said Ran Cohen, CEO & Co-founder at BridgerPay. “At WTM we’ll show how issuer- and geo-aware 3DS, fallback retries of soft declines, and one-click access to local methods can add measurable revenue without more added spend or a risky rebuild.”

What You’ll see at BridgerPay, Stand S3-100:

Bridger 3DS – Adaptive, issuer/geo/risk-aware 3-D Secure: frictionless first; step-up only when it helps.

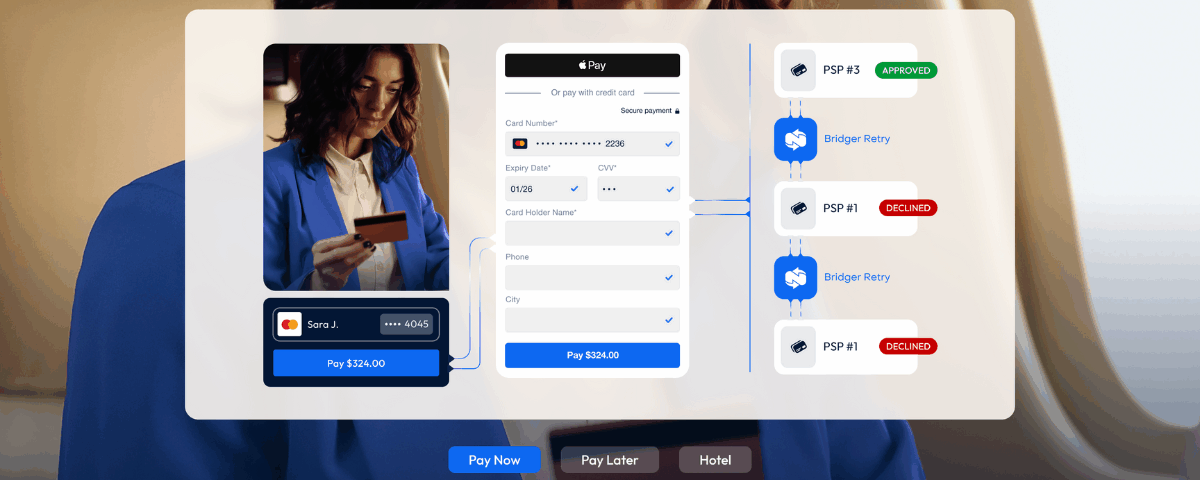

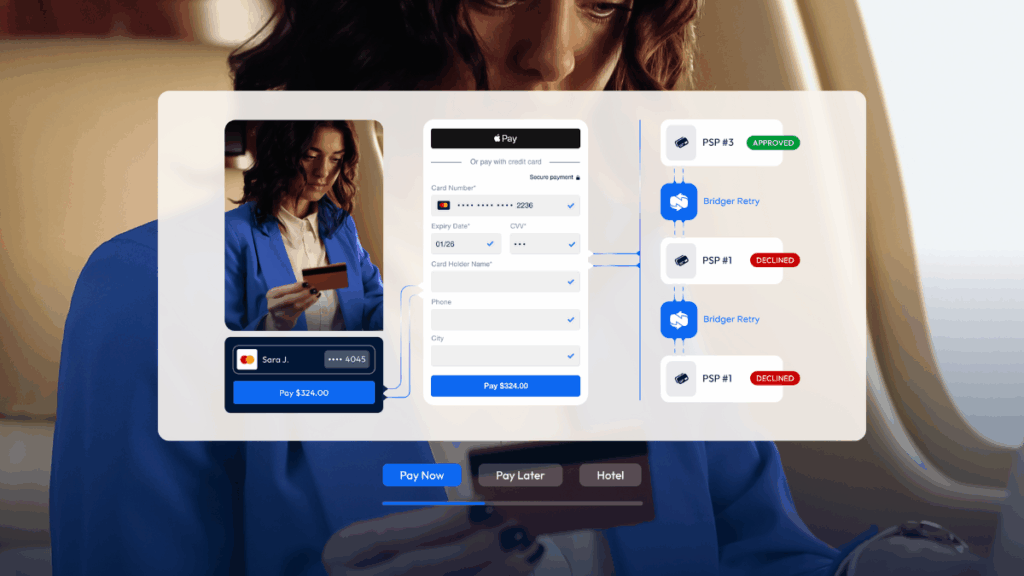

Bridger Retry™ – Rescues up to ~30% of soft-declined card payments by automatically routing to fallback providers/paths (context-dependent).

Connections – One integration to 1,000+ PSPs and local methods across 180+ countries.

Launch the right options without one-by-one builds.

Unified Dashboard – Approvals, declines, authentication outcomes, retries, disputes, settlements & reconciliation – all in one place for faster decisions.

Governance & compliance – SCA-aware policies and support for relevant exemptions where available.

It’s a game changer for travel businesses – and that’s why:

Higher conversion & approvals – Apply 3DS only where issuers expect it; route and retry intelligently to keep real customers in-flow.

Lower chargebacks & fees – Stronger authentication data and cleaner routing reduce disputes (which can carry $20–$25 USD handling costs per case) and unplanned debits.

Faster market entry – Add local APMs quickly, test flows safely, and scale to new geos without locking into a single provider.

Cleaner operations – Automated reconciliation and single-source reporting shorten investigation time and finance close cycles.

“Being born in Cyprus puts us at the crossroads of EU, MENA, and global commerce,” added Nir Bitton, VP of Business Development & Partnership at BridgerPay. “That vantage point shaped a platform that’s both compliance-aware and local-by-design – a great fit for travel’s cross-border reality.”

Meet BridgerPay at WTM

Visit Stand S3-100 or book a meeting: https://bridgerpay.com/

About BridgerPay

BridgerPay pioneers payments orchestration, connecting merchants to 1,000+ PSPs and local payment methods across 180+ countries via a single, seamless API and user-friendly dashboard. Capabilities include fallback routing, tokenization, Bridger Retry™ (which rescues up to ~30% of soft declines, context-dependent), unified analytics, and automated settlements & reconciliation, helping businesses optimize success rates and reduce operational costs.

Media contact:

Shany Daniela Gilat, Marketing Coordinator

shany@bridgerpay.com

+357 94009836