Key Facts

Key Facts

SWOT: Beijing

STRENGTHS

[row][double_paragraph]Wealth of resources…

As China’s capital for more than 600 years, Beijing has a wealth of historical and cultural attractions. Ancient palaces and temples vie for attention alongside modern icons.[/double_paragraph]

[double_paragraph]…and historical and cultural attractions

It is also China’s political, economic and educational centre – home to major government bodies and leading business organisations – as well as being the main transport hub. -[/double_paragraph] [/row]

WEAKNESSSES

[row][double_paragraph]Traffic congestion and pollution

Rapid economic growth has brought problems, such as deteriorating air quality – due to traffic congestion and pollution – posing an increasing health risk and deterring tourism demand.[/double_paragraph]

[double_paragraph]Declining service levels

The dramatic increase in hotel capacity in recent years, largely in the run-up to the 2008 Olympics, has resulted in declining service levels with inadequate foreign language skills.[/double_paragraph] [/row]

OPPORTUNITIES

[row][double_paragraph]Developing a greener environment

Beijing aims to become a low-carbon city, but the first step should be to reduce traffic congestion and industrial waste to clean up the city and improve air quality.[/double_paragraph]

[double_paragraph]Improving city flows

Beijing would be a much more attractive city for non-Chinese-speaking FIT travellers if it were easier to travel around the city independently – by public transport, by bicycle or on foot.[/double_paragraph] [/row]

THREATS

[row][double_paragraph]Poor management of tourism resources

As many historical attractions are managed by government bodies, they are often poorly maintained, provide inadequate services and facilities, and lack innovation in marketing.[/double_paragraph]

[double_paragraph]Difficult access and airport delays

A growing shortage of capacity on international routes and airport delays could encourage more airlines to reduce services to Beijing in favour of regional Chinese airports.[/double_paragraph] [/row]

TOURISM FLOWS

Non-Asian source markets are significant

Main source regions

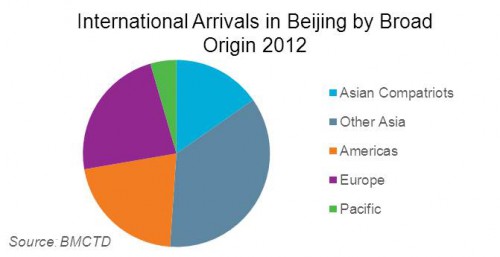

- Contrary to common perceptions, Beijing’s inbound arrivals are not dominated by Asian sources, as China’s are.

- Asia accounts for just over 51% of inbound arrivals, of which 15% is from compatriot markets (Chinese-speaking markets within “Greater China” (ie Hong Kong, Macau and Taiwan)), while non-Asian sources account for the remaining 48%.

- Europe and the Americas (largely North America) represent a well-balanced 23% and 21% of all inbound arrivals, respectively.

Purpose of trip

- Leisure tourism accounts for the highest share of all arrivals in Beijing, although the business and meetings market (MICE travel) generates a reported 40% share overall.

- The MICE segment was declining in share until the 2008 Olympics, faced with growing competition from Shanghai and Guangzhou, but a burst of new construction of meetings venues and hotel accommodation helped Beijing attract greater attention internationally, as well as new business.

- Nevertheless, more recent surveys of satisfaction ratings by ICCA suggest that Beijing’s position has weakened, and risks being further weakened, by traffic congestion, pollution and a still inadequate support structure for the MICE sector.

- One very successful and fast-growing sector is education. In 2011, the total number of foreign students registered for different courses and programmes was 290,000, up 10% over 2010, with the largest numbers coming from South Korea, the US and Japan.

Infrastructure

Infrastructure developments

-

Prior to the opening of Terminal 3 before the 2008 Olympics, BCIA was able to handle 50 million passengers a year. Once Terminal 3 opened, capacity rose by 70% to 85 million.

-

Since current growth projections point to the flow of tourists through Beijing and surrounding areas (including Tianjin) reaching 100 million by 2020, a decision was taken in 2012 to build a new airport in Daxing, 46km south of the capital.

-

Due to (soft) open in 2017, the as yet unnamed airport will have a total annual capacity for 650,000 aircraft movements and 145 million passengers annually when fully completed.

-

After Shanghai Pudong opens its new runway in 2014, it is likely to overtake BCIA in terms of passenger throughput, but this will only be temporary, with Beijing moving into first place in 2017 – in China and likely also the world ranking.

Leading airports and airlines

- Current congestion and a serious shortage of slots mean that BCIA is effectively off-limits to any would-be new entrants, except perhaps those prepared to offer arrivals and departures in the middle of the night.

- Foreign airlines account for some 11-12 million passengers through BCIA – 55% of all international traffic.

ATTRACTIONS

Leading Visitor Attractions

-

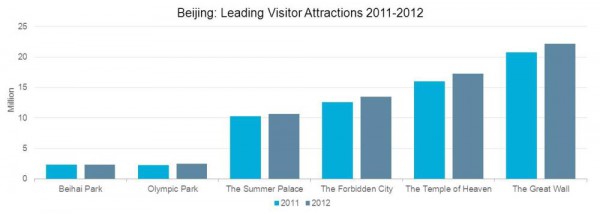

Beijing has the largest number of world-renowned historic sites in China, which together attracted some 1.6 billion visitors in 2012 (up 7.8% over 2011).

-

In recent years, notably since the 2008 Summer Olympics, modern icons such as the Olympic venues and the National Theatre have diversified Beijing’s appeal. Nevertheless, they attract rather fewer visitors than the traditional icons.

-

In first place is the Great Wall, which counted 22.2 million visitors in 2012 (up 6.8% over 2011), followed by The Temple of Heaven (up 8.1% to 17.3 million), The Forbidden City (up 7.2% to 13.5 million) and The Summer Palace (up 4% to 10.7 million).

-

In fifth place some way behind came the Olympic Park with just 2.5 million visitors (up 7.5% over 2011).

Click here to “view full report”