![]()

Key Findings

Internet penetration continues to grow: Internet users are recording steady growth worldwide and reached 2.7 billion globally in 2013. Their rise is expected to continue in the next years driven by Asia Pacific where internet users are expected to be 1.7 billion by 2018.

Internet access goes mobile: Mobile broadband subscriptions outpaced fixed broadband subscriptions over the review period, driven by the popularity of smartphones and tablets, to reach 2.1 billion by 2013.

Strong performance for online travel sales: Global online travel sales amounted to US$590 billion in 2013 and are expected to grow faster than total travel sales in the forecast period, to reach US$950 billion, or 31% of total travel sales by 2018.

Asia Pacific drives online travel growth :Asia Pacific is expected to drive global growth in online travel in the forecast period, with its online travel sales more than doubling from US$85 billion in 2013 to US$190 billion in 2018.

Multiscreen consumers: Consumers today use multiple internet devices in a sequential or simultaneous manner. Travel companies need to build a flexible technological architecture in order to reach them, including a presence in wearable technologies.

Success of the peer-to- peer model : Recent years have seen the rise of the peer-to-peer model in the travel industry. Today consumers not only share their reviews and comments online with their peers but also successfully provide them with travel services.

Big data to revolutionise online travel marketing: Big data analytics will increasingly enable companies to target consumers in a more personalised and effective way. In the next few years, we will witness a gradual move from mass marketing to 1-to-1 marketing in online travel.

GLOBAL OVERVIEW

Global online travel sales recording healthy growth

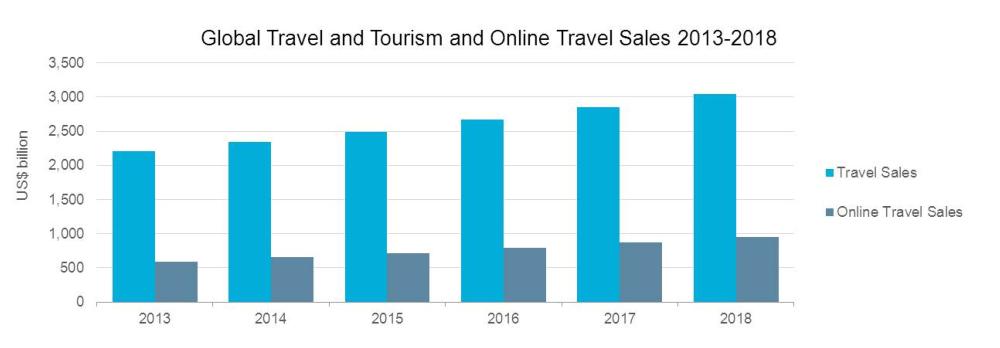

- Global travel and tourism sales amounted to US$2,200 billion in 2013, and are expected to record a healthy 7% CAGR over the 2013-2018 period, driven by the steady rise of international and domestic trips, and in particular by the rising popularity of tourism among the rising middle and affluent classes of the emerging markets. As a result of this growth, global travel and tourism sales are expected to reach US$3,000 billion by 2018.

- Global online travel sales amounted to US$590 billion in 2013, constituting 27% of total travel and tourism sales. They are expected to grow faster than the total industry between 2013 and 2018, recording a 10% CAGR, and reaching US$950 billion by 2018.

Note: including both direct sales and sales through intermediaries in the transportation, travel accommodation, car rental and tourist attractions markets.

GLOBAL OVERVIEW

Air leading sector for online travel sales, followed by hotels

- Transportation is the largest market within the travel and tourism industry in terms of both total and online sales. Transportation online sales amounted to US$399 billion in 2013, constituting 32% of total transportation sales. The air sector accounted for the vast majority of online sales, at US$365 billion – 47% of total air sales – while the online channel accounted only for 7% of other transportation sales.

- Travel accommodation was the second largest online travel market in 2013, amounting to US$170 billion, with a 25% share of total sales. The online channel accounted for 29% of total sales for hotels and a 16% share for other travel accommodation types.

- Car rental and tourist attraction online sales amounted to US$23 and US$10 billion, respectively, in 2013. The share of online sales was especially high for car rental, at 39%, while they accounted for only 4% of total sales in the tourist attractions market.

Note: Including both direct sales and sales through intermediaries.

GLOBAL OVERVIEW

Western Europe leads online travel sales

- Western Europe was the leading world region in terms of online travel sales in 2013. Online travel sales amounted to US$212 billion, or 37% of its total US$570 travel and tourism sales.

- North America was the second largest world region in 2013, with online travel sales of US$208 billion, or 41% of its total US$504 billion travel sales.

- Asia Pacific was the leading region for total travel and tourism sales in 2013, at US$669 billion, but was only the third largest region in terms of online travel sales (US$85 billion) due to a lower penetration of the online channel (13% of total travel and tourism sales). This region is expected to record rapid growth in terms of online travel sales over the 2013-2018 period, at a 15% CAGR.

- Australasia recorded the highest penetration of the online channel in 2013, at 54%, with sales of US$29 billion.

Note: including both direct sales and sales through intermediaries in the transportation, travel accommodation, car rental and tourist attractions markets.

Click here to “view full report”