![]()

Key Findings

Steady performance for online travel intermediaries: Global online travel intermediaries sales recorded a strong 8% CAGR over the 2008-2013 period, driven by the rapid rise of online travel agencies and by the move of traditional tour operators to the online channel.

Asia Pacific and mobile channel to drive future growth: Growth is expected to stay very healthy over the forecast period, with strong performances in the Asia Pacific region and in sales made through mobile devices.

The rise of technology players: Technology players, such as Google, Facebook, TripAdvisor and the metasearch engines, are playing an increasingly important role in the travel industry, driving online traffic and having a major impact on competition among industry players.

Increasing consolidation for OTAs: The online travel agency sector is seeing increasing consolidation, with Expedia and Priceline emerging as its dominant players. OTAs from the emerging markets, such as Ctrip and MakeMyTrip, are also gaining ground.

Tour operators embrace online channel: Leading global tour operators, such as TUI Travel and Thomas Cook, are currently changing their business models to make their websites their main distribution platforms.

A fast changing environment: Further major changes are expected over the forecast period as peer-to-peer services expand to more travel sectors, online travel marketing becomes increasingly personalised and wearable electronics go mainstream.

From OTAs to MTAs: As a result of the rise of the mobile channel and of in-destination tourist services, online travel agencies are expected gradually to adopt a mobile travel agency model.

SECTOR PERFORMANCE

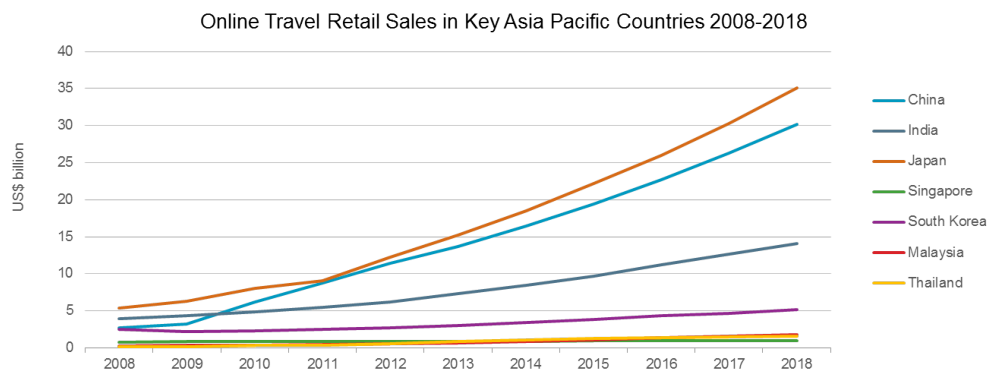

Asia Pacific the driver of growth

- Asia Pacific is expected to drive global online travel retail growth in the 2013-2018 period, recording a 16% CAGR. Thanks to this rapid growth, Asia Pacific is expected to account for 24% of global online travel retail sales by 2018. Over the 2013-2018 period the penetration of the online channel in travel retail sales in the region is expected to increase from 24% to 38%.

- Japan and China are by far the largest online travel retail markets in Asia Pacific, at US$15 billion and US$14 billion in 2013, respectively. India is the third largest market in the region, at US$7 billion in 2013, and is expected to record a 14% CAGR over the 2013-2018 period.

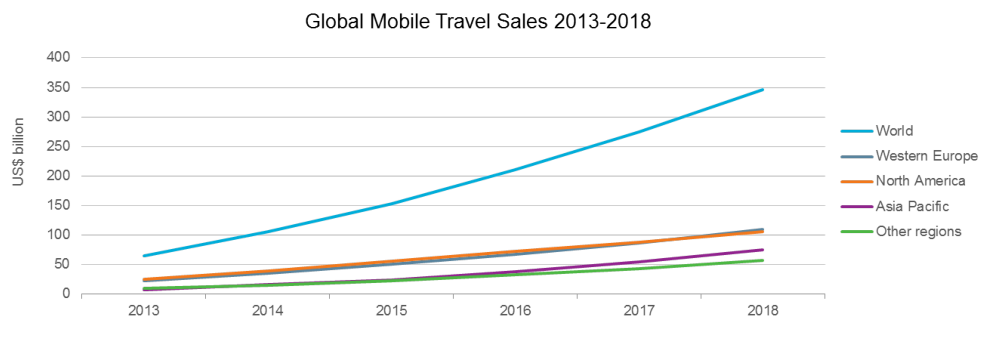

Mobile travel sales to see rapid growth over 2013-2018

- Within online travel sales, the mobile channel, including sales made through smartphones and tablets, is expected to see the fastest growth over the forecast period. Global mobile travel sales, including both sales made through intermediaries and direct sales, are expected to record a 40% CAGR between 2013 and 2018, reaching US$350 billion.

- Behind this sharp growth is the rising trend among consumers to use smartphones and tablets not only for searching for travel products but also to book them. Over the forecast period, consumers will become increasingly accustomed to finalising bookings on smaller screens, while travel companies will make bookings and payments through smartphones more convenient, and average sizes of smartphone screens will increase.

FUTURE OUTLOOK

The rise of mobile travel agencies (MTAs)

- The shift from desktop to mobile internet access is having a significant impact on the travel industry, making smartphones and tablets an important booking channel, as well as customer service tool. Always-connected travel consumers expect to receive customer service, and also the opportunity to make additional bookings, not only before the trip but also during the trip.

- The rising importance of mobile devices means an increased focus for travel companies on the period after the booking and throughout the whole travel experience. This is expected to result in online travel agencies gradually changing their business model to become mobile travel agencies (MTAs).

- MTAs will be constantly reachable from consumers on-the-go to provide assistance, additional services and additional booking options. New services will include the possibility to make bookings not only through smartphones and tablets but also through wearable electronics, connected cars and in-flight screens.

- Other services provided through mobile devices will include personalised offers based on consumer profiles, convenient payment options, directions to get to the hotel when at the destination, check in and check out, concierge services, room choice, mobile devices to be used as room keys, information on and reservation of local activities, reservation of additional hotel rooms and nights and of other tourist in-destination services, such as tours, meals, car rental and shopping for local products.

Click here to “view full report”