INTRODUCTION

Key Findings

Sydney for fun

Home of world-famous landmarks, attractions, natural parks and experiences to suit all tastes and budgets, Sydney is a major leisure destination.

Strong prospects for MICE

Although leisure accounts for the bulk of arrivals to Sydney, current investment in high-end exhibition and convention centres will attract more events to the city and raise its profile as a MICE destination.

Eyes on the Chinese

China continues to outrank all other source markets, making up 14% of total inbound arrivals to Sydney. This is set to increase as the city gains exposure through greater promotional activity and enhanced air links.

Domestic tourism back on track

With the Australian dollar depreciating and Generation Y settling down after globe-trotting years to have a family, Australians’ holiday-making desires are shifting closer to home. This is positively impacting domestic tourism flows, which recorded a 7% increase in 2013.

Sydney Airport

The newly approved Master Plan 2033 will bring Sydney Airport to new heights, improving passenger experience, increasing airport efficiency, enhancing safety and maximising capacity.

Focus on experiences

Destination NSW is increasingly promoting experiences, instead of touristic sites. Current priorities are high yield sectors, such as Youth, Food and Wine, and Cruises.

Bright outlook

Travel and tourism in Sydney is expected to continue to thrive, prompted by the city’s unquestioned popularity as a leisure destination and growing business prospects in Australia and abroad.

TOURISM FLOWS

Tourism overview: Key trends

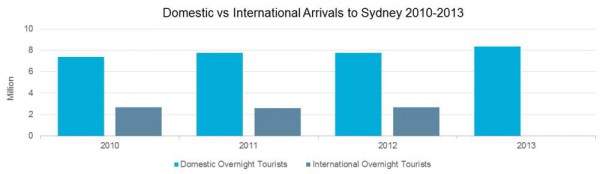

- Overnight visitor arrivals in Sydney reached 10.5 million in 2012, up by 1% over 2011.

- International overnight tourist arrivals totalled 2.7 million in 2012, recording 4% growth from the previous year. Domestic overnight tourist arrivals grew by less than 1% to a total of 7.7 million over the same period.

- In 2013, domestic overnight tourist arrivals performed better, with a 7% increase, leading to 8.3 million arrivals. The depreciation of the Australian dollar has helped this trend, as domestic tourists postponed plans to travel abroad as such trips became more costly and domestic holidays came back into vogue.

- 2013 data for international arrivals are not available yet as a result of a delay in the release of the International Visitor Survey (IVS) results for December 2013 to 30 April 2014. Tourism Research Australia is changing the Overseas Arrivals and Departures (OAD) data.

Business versus leisure

-

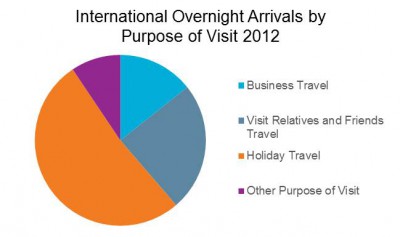

Source: Tourism Research Australia In 2012, 52% of total international arrivals were for leisure purposes. Visiting relatives and friends came next, representing 24% of international arrivals.

-

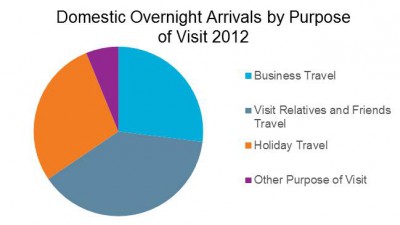

Source: Tourism Research Australia Leisure accounted for 28% of domestic arrivals in 2012. In 2013, leisure arrivals were stronger and almost returned to 2009 levels, as the depreciation of the Australian dollar made domestic trips more attractive than international trips.

- Business travel was stronger amongst domestic tourists, given the importance of Sydney as an economic and financial hub within Australia.

- Compared to domestic business arrivals, the number of international business arrivals is rather small, with Melbourne being Sydney’s strongest competitor in the MICE segment.

- This is expected to change, however, as a number of state-of-the-art exhibition and convention centres are completed in the upcoming years, attracting a larger number of business events to Sydney and enhancing its competitive positioning in the MICE segment.

Chinese Tourism Law threatens booming arrivals from China

- Growth in Chinese arrivals will continue to be the defining characteristic of Australian inbound tourism in the upcoming years.

- Arrivals from China currently make up 14% of total inbound arrivals to Sydney, but this is set to increase as the city gains exposure through greater promotional activity and enhanced air links.

- Chinese tourism will, however, be held back in the short term by the introduction of the China Tourism Law in October 2013, which outlawed many of the practices that Chinese travel retailers had used to sell their travel products, most notably “subsidised shopping tours”.

- Under such tours, Chinese tourists were sold cheap chartered tours, which were subsidised by travellers being coerced into shopping at specified souvenir shops.

- The new law caused October and November 2013 to be weak months for Chinese arrivals, but December saw a strong rebound. Although it is too soon to tell what the impact of the legislation will be, it is likely to be only a short-term blip. Chinese travellers are likely to adjust to the higher upfront costs of a tour.

- The Australian Federal Government has proposed one measure that is likely to give the process an additional boost. This is a streamlined visa application process, which is likely to include the ability for visas to be lodged electronically. Applying for a visa has previously been a complicated procedure for Chinese nationals.

- In the meantime, the medium term impact is still unknown, at least until the proposed measures aimed at speeding up the visa process come into effect.

Click here to “view full report”