Phocuswright has been tracking the size and growth of total and online travel markets for over two decades. In 2017, we sized the total market globally at US$1.6T. While online channels have experienced strong growth, continuously outpacing the total market, digital share of the market only remains around 50% in mature markets and far less in emerging markets. Online travel agencies (OTAs) have led the way in transforming the marketplace from offline to online. Expedia Group and Booking Holdings dominate the OTA market, capturing roughly two thirds of the global market across their portfolio of brands.

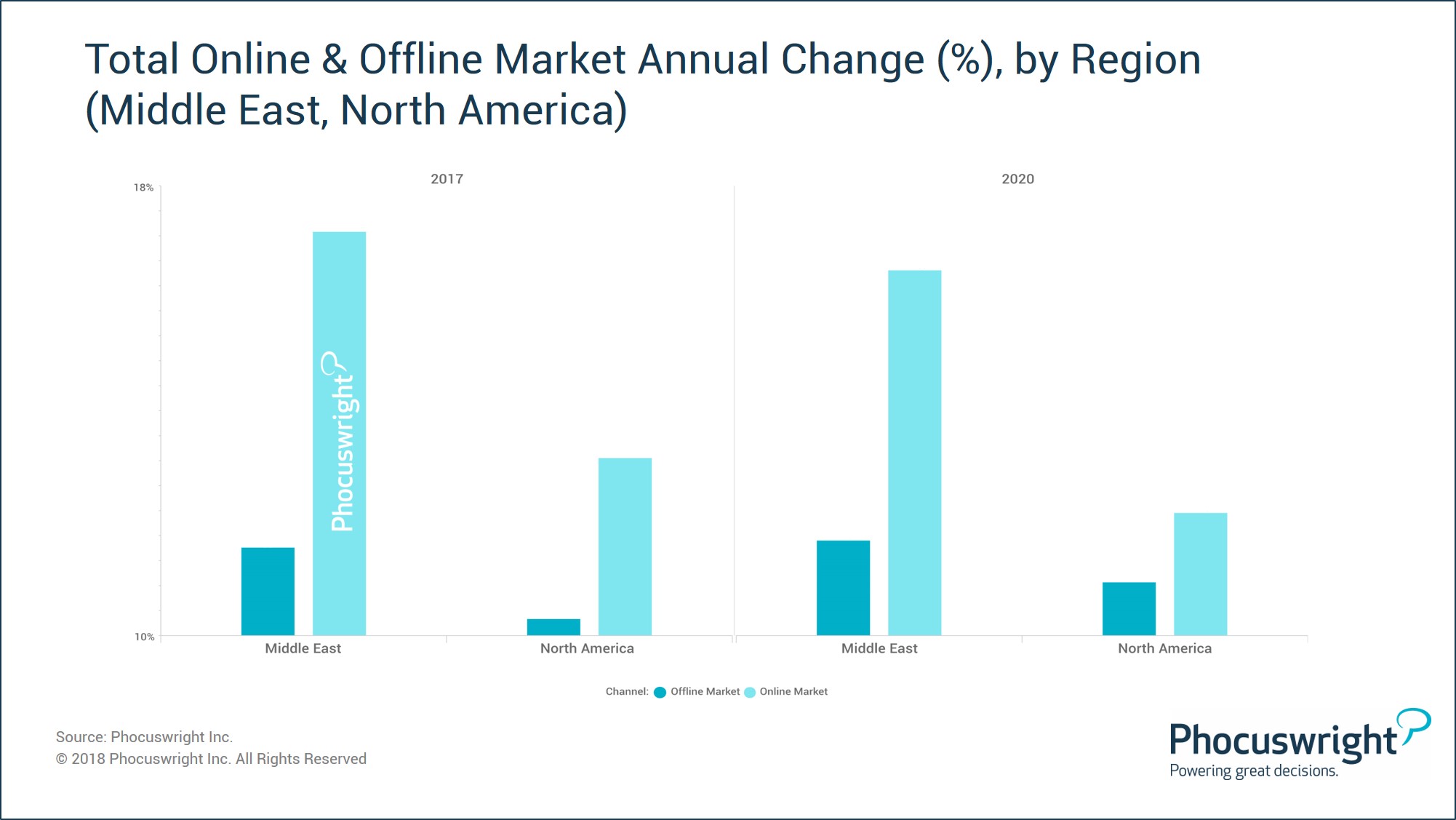

How does the Middle East stand up against both mature travel markets and emerging travel markets? To simplify cross-market comparisons, Phocuswright created Phocal Point, a data visualization tool to efficiently benchmark growth and online penetration rates across all of the markets we cover. First, let’s compare North America, a mature travel market with the Middle East. In 2017, the online market in the Middle East grew at a healthy 15%, while offline channels grew at only 4%. North America was a bit more sluggish, with online channels growing at 7% and offline at only 1%. As we look forward a few years to 2020, we anticipate that the online market in the Middle East will continue strong growth in the mid-teens, while in North America, the growth rate will slow by a couple of percentage points.

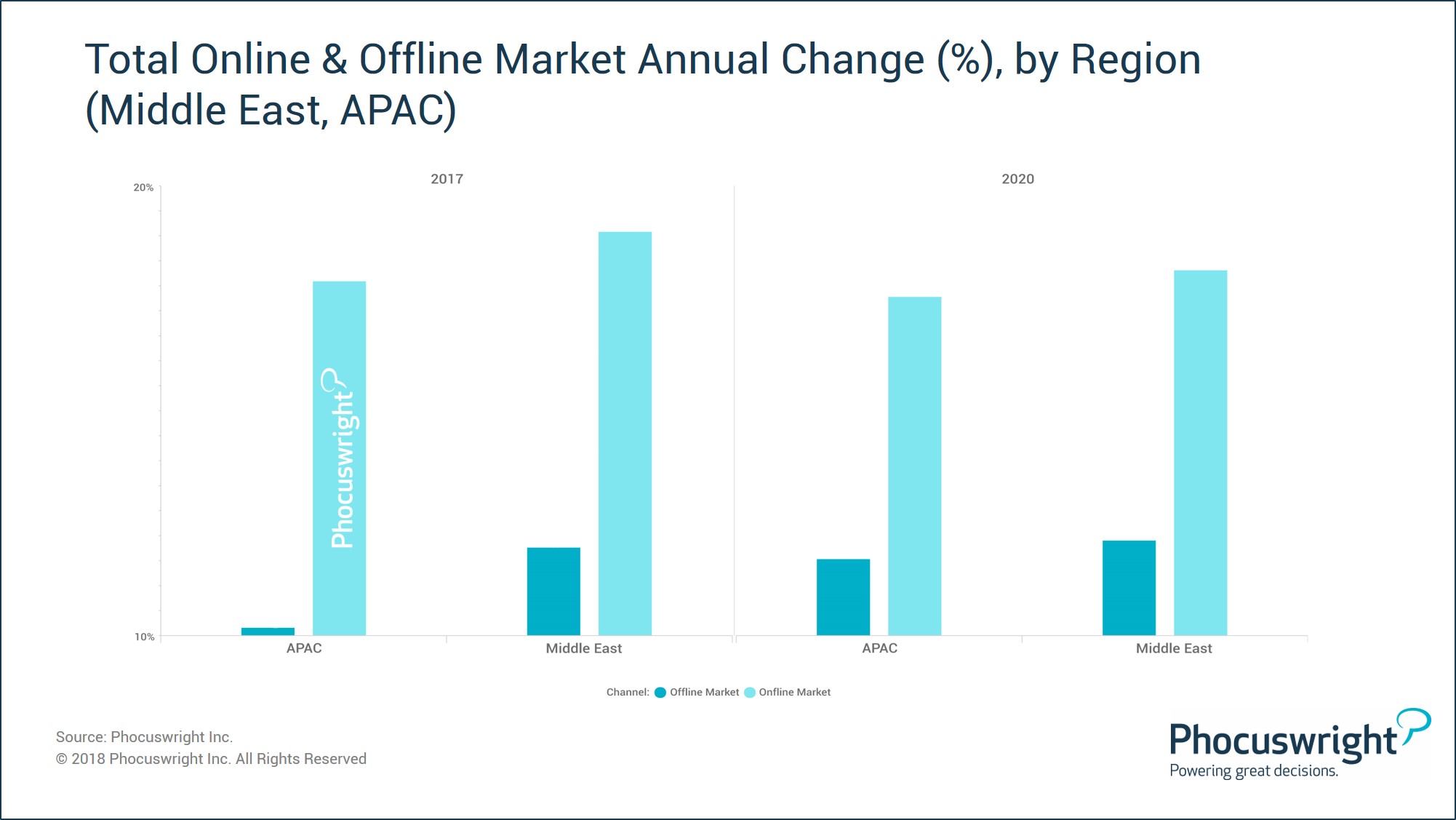

Next, let’s compare the Middle East with the Asia Pacific (APAC) region to move from a comparison with a mature market to a comparison with a growth market. As one might expect, the numbers start to look a bit more similar. In 2017, the online market in APAC grew at 14%, while offline channels were flat. As we look ahead to 2020, the regions compare nearly identically, with low- to mid-single digit growth in the offline market and mid-teen growth in the online market.

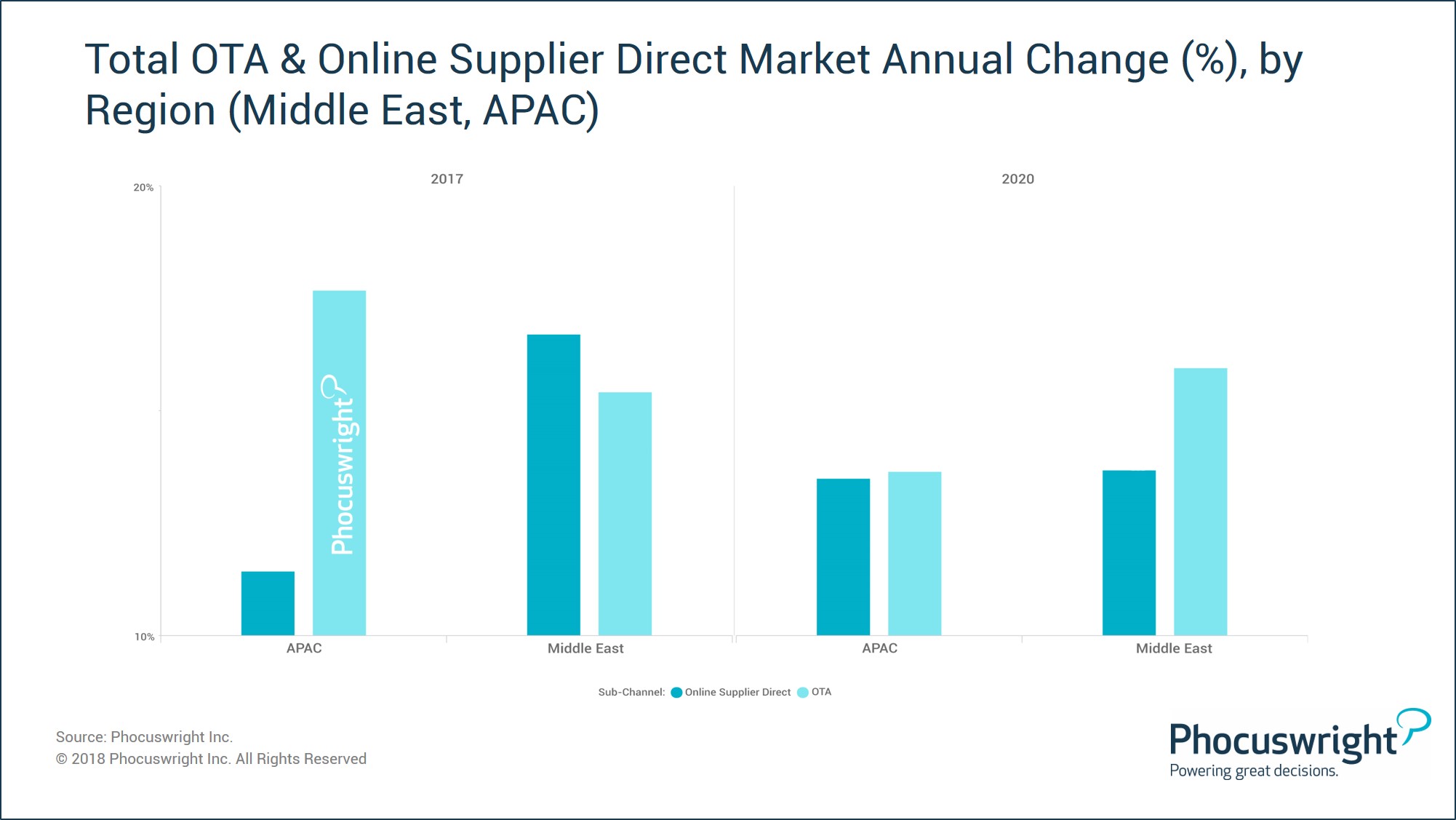

While the APAC and Middle East region look quite similar in terms of growth rate of online and offline channels, the story changes a bit when we dig into the online channel to see where the growth is coming from. In 2017 in APAC, the OTA channel grew at a 18% clip, while online supplier direct grew at only 12%. In the Middle East, the numbers are reversed, with online supplier direct growing at 17% and OTA growing at a slightly slower 15%.

In summary, the Middle East region looks more similar to Asia Pacific than the more mature North American market. However, when you dig in a bit deeper, the online markets are driven by different dynamics, with suppliers in the Middle East maintaining a bit more leverage over the OTAs in the region.

Dig deeper into these trends and much more on Tuesday, 24 April (10:30), in Arabian Travel Market’s Travel Tech Theatre. Phocuswright’s Middle East market specialist, Cristina Polo, and a panel of experts explore the burgeoning private accommodation segment in the Middle East.

Get a detailed view of the Middle East travel markets – including market sizing and projections through 2021 – with Phocuswright’s Middle East Online Travel Overview Third Edition.