![]()

AIR SEGMENT BACKGROUND

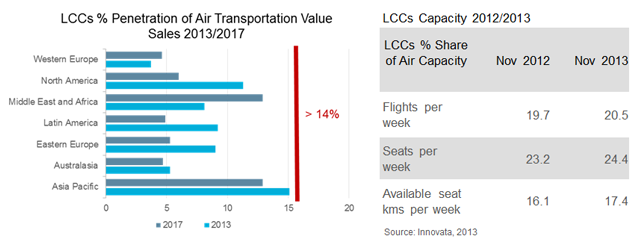

LCCs still increasing share

- LCCs continue to take share from the schedule operators globally, and have been particularly favoured by cost conscious travellers in a time of economic uncertainty.

- Asia Pacific is expected to be the leading region in terms of value sales growth over the period 2013-2017, recording a 14% increase, followed by Middle East and North America.

- Players such as AirAsia, Spring, Cebu Pacific, Indigo, Lion Mentari and Tiger Airways are some of the carriers contributing to the increasing popularity of the segment in the region. Asia Pacific is home to some of the key countries expected to record significant growth in tourist arrivals over the next five years, including Vietnam, Myanmar, Uzbekistan and the Philippines.

SWOT: LCCs

STRENGTHS

[row][double_paragraph]Cruising destination

The advance of LCCs, which are opening new routes and boosting migration from other transportation modes, is reducing the market share of the major legacy carriers. [/double_paragraph]

[double_paragraph]Diverse leisure offering

The business model of LCCs is one based upon low fares and recurrent promotions, which act as magnet for travellers. Modern fleets and low operating costs help maintain their advantage over rivals. [/double_paragraph] [/row]

WEAKNESSES

[row][double_paragraph]Weak business tourism

Overcapacity driven by the strong growth of the LCCs and aggressive aircraft orders, along with increasingly congested airports, are factors that weaken this segment. [/double_paragraph]

[double_paragraph]Domestic spending

Competition from schedule operators venturing into the sector through price cuts are placing pressure on LCCs, as it will reduce passenger bookings and thus profitability. [/double_paragraph] [/row]

OPPORTUNITIES

[row][double_paragraph]New Territories

As many LCCs reach maturity, diversification of geographical reach to Asia Pacific and the Middle East and Africa offers opportunities for growth. [/double_paragraph]

[double_paragraph]More perks for business travel

Business sections on board aircraft can appeal to higher yield passengers and boost profitability. Adopting innovative practices will be crucial to remaining competitive. [/double_paragraph] [/row]

THREATS

[row][double_paragraph]High Speed Rail

The convenience and efficiency of high speed rail is posing a threat to LCCs. Cutting waiting times and avoiding commutes from secondary airports offers advantages for travellers. [/double_paragraph]

[double_paragraph]Fuel Prices

Any fuel price spikes and a tough economic and business environment will put pressure on the segment and the overall financial performance of LCCs. [/double_paragraph] [/row]

LCC PERFORMANCE

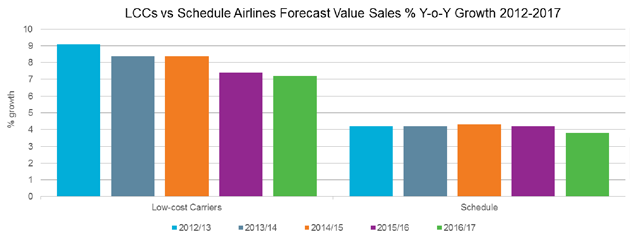

Schedule vs LCCs growth

- LCCs were once again the best performing air category in 2012, with global growth of 9% in terms of constant value sales as travellers opted for less expensive ticket offers. South Korea is expected to record the strongest rise within the LCC segment over the 2012-2017 period, with 45% annual average growth. Unlike international LCCs, such as AirAsia, South Korean LCCs have a different culture, offering a free in-flight beverage service or meal service.

- Israel is another market expected to experience strong growth, especially if “open skies” agreement is approved, which will lead to dramatic increase in flight volumes, alongside price decreases, since many LCCs will boost their route networks in the country.

Africa back on the airline map

- With a number of new airlines in Africa, it is hoped by operators that 2014 will finally be the year when LCCs will start to achieve their potential in the region. The launch of Fastjet in 2012 and Skywise from South Africa in 2013, to be followed by Kenya Airways’ Jambo Jet, signals the take-off of the low-cost travel industry in the region, which could contribute to strong growth in the intra-regional travel market.

- Fastjet is expected to boost intra-regional travel, with planned bases in Tanzania, Kenya, Ghana and Angola. It will make travel more affordable to a larger traveller base, and is likely to service many destinations.

- However, the development of the low-cost market in the region is restricted by the lack of secondary airports, as well as tight regulations favouring national legacy carriers. Tanzania and Kenya are the only nations to have secondary domestic airports, with other countries restrict inter-regional departures to capital airports, which tend to have higher fees.

Snapshot of LCCs in Africa 2013

[row][third_paragraph]Fly 540 [/third_paragraph]

[paragraph_right]Kenyan LCC, continues to operate regional routes, despite an ongoing dispute with Fastjet which purchased shares in the airline in 2012, planning to merge operation

[/paragraph_right][/row]

[row][third_paragraph]Fastjet [/third_paragraph]

[paragraph_right]Fastjet, owned by easyJet founder Sir Stelios Haji-loannou, files domestic routes from Dares Salam to Kilimanjaro and Mwanza

[/paragraph_right][/row]

[row][third_paragraph]Jambo Jet [/third_paragraph]

[paragraph_right]Kenya Airways has obtained regulatory approval for low-cost subsidiary Jambo Jet, with the rights to 22 domestic and East Africa routes

[/paragraph_right][/row]

[row][third_paragraph]Air Arabia [/third_paragraph]

[paragraph_right]The Sharjah-based airline flies to Nairobi, Kenya, four times a week

[/paragraph_right][/row]

[row][third_paragraph]Fly Dubai [/third_paragraph]

[paragraph_right]The Dubai LCC flies to Addis Ababa and Dijibouti three times a week from its base in the UAE

[/paragraph_right][/row]

Low-cost goes upmarket

Opportunities and Future Outlook

- Luxury brands are important, and high-end experiences offering comfort and personalised entertainment are favoured among Middle Eastern consumers. A less expected outcome of the luxury orientation of Middle Eastern travellers is the introduction of luxury services aboard LCCs.

- Jazeera Airways was the first to introduce a business class in 2009, straying away from the low-cost model altogether, but keeping low prices and achieving good profitability. In 2013, flydubai followed suit with its new business class services.

- While the Jazeera shift towards a traditional model was the result of low profitability, the 2013 flydubai business class tells another story, one of a LCC adding a luxury edge. “Affordable luxury” aboard planes appears to be an attractive segment, as business class tickets introduced by these LCCs would be cheaper than traditional airlines’ business class. This way, LCCs would lure economy customers away from traditional airlines, attracting who can afford a slightly more expensive ticket for a higher end experience.

Possible contagion?

Contagion can go two ways with this trend:

- Other categories may adopt affordable luxury, eg budget hotels offering some higher end rooms. LCCs from other regions could adopt the “hybrid model”, blending low-cost and luxury, the most likely being Asia, where luxury is favoured. However, some are sceptical regarding the hybrid model, as it is seen as having a negative impact on airlines‘ profitability because of the higher costs incurred.

Click here to “view full report”